daisy.net.ru Tools

Tools

Pmi Coverage

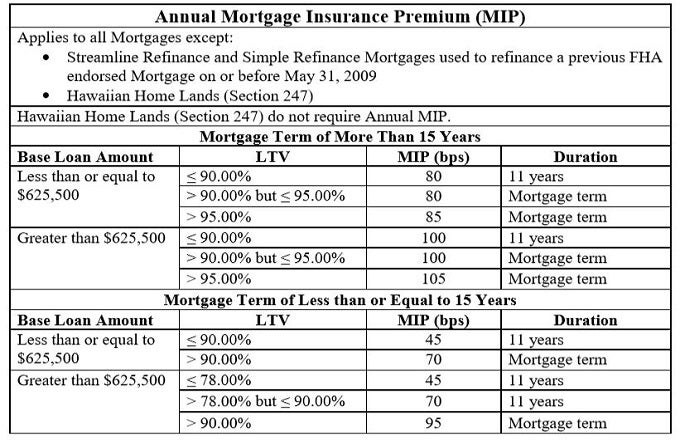

Personal life insurance can be used to cover any home with any mortgage lender or repayment terms. Cost. Mortgage life insurance cost % to 4% of the mortgage. Private Mortgage Insurance protects the lender if you default on the loan. But did you know that federal law may allow you to cancel that insurance and avoid. Private mortgage insurance (PMI) is insurance that a mortgage lender may require you to purchase if your down payment is less than 20%. The Act, also known as the “PMI Cancellation Act,” addresses homeowners' difficulties in canceling private mortgage insurance (PMI)1 coverage. It establishes. Traditional banks and private lenders require homebuyers to pay for private mortgage insurance when they make a down payment less than 20 percent. Private. PMI must be cancelled automatically once the LTV reaches 78 percent based on the original amortization schedule or when the midpoint of the amortization period. PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. How does PMI work? PMI acts as a guarantee that, if a borrower defaults on a mortgage, the insurer will pay the mortgage lender for any losses they incur in a. Lenders generally require PMI when your down payment on a home is less than 20% of the home's total value. The lender chooses the PMI company. Personal life insurance can be used to cover any home with any mortgage lender or repayment terms. Cost. Mortgage life insurance cost % to 4% of the mortgage. Private Mortgage Insurance protects the lender if you default on the loan. But did you know that federal law may allow you to cancel that insurance and avoid. Private mortgage insurance (PMI) is insurance that a mortgage lender may require you to purchase if your down payment is less than 20%. The Act, also known as the “PMI Cancellation Act,” addresses homeowners' difficulties in canceling private mortgage insurance (PMI)1 coverage. It establishes. Traditional banks and private lenders require homebuyers to pay for private mortgage insurance when they make a down payment less than 20 percent. Private. PMI must be cancelled automatically once the LTV reaches 78 percent based on the original amortization schedule or when the midpoint of the amortization period. PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. How does PMI work? PMI acts as a guarantee that, if a borrower defaults on a mortgage, the insurer will pay the mortgage lender for any losses they incur in a. Lenders generally require PMI when your down payment on a home is less than 20% of the home's total value. The lender chooses the PMI company.

Private Mortgage Insurance, or PMI, is required by most lenders if the borrower is unable to put down less than 20% of the appraised home value or sale price. PMI is mortgage insurance required on most loans when buyers don't pay at least 20% of the home's purchase price as a down payment. If you are in the market to buy a new home and have less than a 20 percent down payment, you are usually required to buy private mortgage insurance. This article explains the differences between these two types of coverage, and how they could affect you as a borrower. The table below highlights their standard coverage requirements, as well as coverage requirements for HomeReady, Home Possible and Charter Minimum Coverages. Mortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee (MIG), particularly in. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. Mortgage insurance costs, qualification requirements, product options, CMHC Eco Plus and more. Mortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee (MIG), particularly in. Private Mortgage Insurance (PMI) is a necessary add-on faced by some buyers required to carry the added protection in order to obtain financing. r. Private Mortgage Insurance (PMI) is insurance that protects your lender against non-payment should you default on your loan. call now This topic contains information on mortgage insurance coverage requirements for first-lien mortgage loans. PMI is a type of mortgage insurance that's usually required with a conventional loan when the buyer makes a down payment of less than 20% of the home's value. What Is Private Mortgage Insurance? PMI is an insurance policy that protects the lender in case you default on your mortgage. "Mortgage insurance is generally. Private mortgage insurance enables borrowers to gain access to the housing market more quickly, by allowing down payments of less than 20%, and it protects. PMI is an added insurance policy for homeowners who put less than a 20% down payment and is designed to protect the lender if you are unable to pay your. Mortgage insurance offers the lender an extra layer of protection when you buy a home. If you take out a home loan with a down payment under 20%, mortgage. Canceling mortgage insurance · The requirements vary depending on your loan type and applicable state, federal and investor guidelines. · Please call us at Private Mortgage Insurance (PMI) is an insurance policy, separate from homeowner's hazard insurance coverage, that is usually required by the lender if the. How much is PMI and how do PMI payments work? PMI costs vary, depending on your loan type, but plan to pay between 1% and 3% of your home's purchase price. PMI.

Best Pillow For Stomach Sleepers Amazon

Coop crescent pillow! It's so great for both side sleeping and stomach sleeping. There is also a cooling version. Well worth the money and they. DreamyBlue Premium Pillow for Sleeping - Shredded Memory Foam Fill [Adjustable Loft] Washable Cover from Bamboo Derived Rayon - for Side, Back, Stomach Sleepers. Bed Pillows Standard Size Set of 2, % Cotton Cover Hotel Pillows for Side Back and Stomach Sleepers, Cooling Fluffy Down Alternative Microfiber Filled for. With memory foam or cooling & breathable mesh, Bedgear performance pillows are designed to fit your sleep position and body type. Find Your pillow Fit. DreamyBlue Premium Pillow for Sleeping - Shredded Memory Foam Fill [Adjustable Loft] Washable Cover from Bamboo Derived Rayon - for Side, Back, Stomach Sleepers. The Emma Hybrid Comfort is a firm, supportive, and bouncy mattress. A good fit for back sleepers and stomach sleepers, it also has open-celled foam for cooling. Ultra thin pillow for sleeping, slim stomach sleeping pillow for shoulder neck pain relief, low profile memory foam pillows with washable cover. The Saatva Latex Pillow has an adjustable design that served all side sleepers on our test team regardless of their loft leanings. How It Performs. The pillow. Side sleeper here and the Purple Harmony pillow is a winner. Have had it almost 2 years and doesnt go flat or anything. Coop crescent pillow! It's so great for both side sleeping and stomach sleeping. There is also a cooling version. Well worth the money and they. DreamyBlue Premium Pillow for Sleeping - Shredded Memory Foam Fill [Adjustable Loft] Washable Cover from Bamboo Derived Rayon - for Side, Back, Stomach Sleepers. Bed Pillows Standard Size Set of 2, % Cotton Cover Hotel Pillows for Side Back and Stomach Sleepers, Cooling Fluffy Down Alternative Microfiber Filled for. With memory foam or cooling & breathable mesh, Bedgear performance pillows are designed to fit your sleep position and body type. Find Your pillow Fit. DreamyBlue Premium Pillow for Sleeping - Shredded Memory Foam Fill [Adjustable Loft] Washable Cover from Bamboo Derived Rayon - for Side, Back, Stomach Sleepers. The Emma Hybrid Comfort is a firm, supportive, and bouncy mattress. A good fit for back sleepers and stomach sleepers, it also has open-celled foam for cooling. Ultra thin pillow for sleeping, slim stomach sleeping pillow for shoulder neck pain relief, low profile memory foam pillows with washable cover. The Saatva Latex Pillow has an adjustable design that served all side sleepers on our test team regardless of their loft leanings. How It Performs. The pillow. Side sleeper here and the Purple Harmony pillow is a winner. Have had it almost 2 years and doesnt go flat or anything.

HOMBYS Ultra Thin Flat Bed Pillow for Stomach Sleepers and Back Sleepers,inch Standard Size Down Alternative Pillow, Best Pillow for Sleeping,% Cotton. Derila Memory Foam Pillow is The Perfect Bed Pillows for Side, Back, Stomach Sleepers. Neck Contoured Support Pillow Improves Sleep. You Will Wake up Refreshed. No, it's quite soft. · I wouldn't call it extra firm. · I bought the medium firm pillows. · Will this pillow hold its shape while side-sleeping? side sleeper and this pillow makes sleeping so much better for me. With a CPAP you'll never be able to sleep on your stomach again, but I've gotten my best. The Stomach Sleeping Specialist: Our belly sleeper pillow provides ideal support for stomach sleepers with its contoured and supportive design. Memory Foam Cooling Sleep Pillow, Orthopedic Cervical Neck Pillow for Side & Back & Stomach Sleepers, Ergonomic Contour Pillow for Back and Shoulder Pain Relief. Find helpful customer reviews and review ratings for Hcore Ultra Thin Pillow " Stomach Sleeping, Slim Pillow for Side Back Stomach Sleepers. A gel pillow is a good option for stomach sleepers because they often sleep hot while lying face down. Memory foam pillows are the ones that are. The 6 Best Pillows on Amazon for Every Type of Sleeper · Best Adjustable Pillow · Sweetnight Standard Adjustable Down Alternative Pillows (set of 2) · We Recommend. Snuggle-Pedic Shredded Memory Foam Pillow - The Original Cool Pillows for Side, Stomach & Back Sleepers - Sleep Support That Keeps Shape - College Dorm Room. Low-profile, flat pillow for stomach and back sleepers, reducing neck and shoulder pain. Provides pressure relief and neck support, made of CertiPUR-US and Oeko-Tex. Beckham Hotel Collection Bed Pillows Standard / Queen Size Set of 2 - Original Down Alternative Pillow for Sleeping - Bedding for Back, Stomach or Side Sleepers. What I recommend to patients who are back/side sleepers is either a latex pillow, or what's called a Therapeutica. Latex is neutral - there are. The Cozy Earth Silk Pillow is a great example of a pillow that supports the neck and is low enough for strict stomach sleepers. Made of bamboo fabric and %. BLISSBURY Stomach Sleeping Pillow - Thin Memory Foam Pillow for Stomach Sleepers | Ultra Thin Pillow for Sleeping | Flat Pillows for Sleeping, Slim Pillow. HOMBYS Ultra Thin Flat Bed Pillow for Stomach Sleepers and Back Sleepers,inch Standard Size Down Alternative Pillow, Best Pillow for Sleeping,% Cotton. Side Sleeper Pillows for Adults Skin-Friendly Bed Pillow Hotel Pillows for Bed Memory Foam 1pcs: Bed Pillows - daisy.net.ru ✓ FREE DELIVERY possible on eligible. Side Sleeper Pillows for Adults Skin-Friendly Bed Pillow Hotel Pillows for Bed Memory Foam 1pcs: Bed Pillows - daisy.net.ru ✓ FREE DELIVERY possible on eligible. BLISSBURY Stomach Sleeping Pillow - Thin Memory Foam Pillow for Stomach Sleepers | Ultra Thin Pillow for Sleeping | Flat Pillows for Sleeping, Slim Pillow. These are the best pillows for stomach sleepers, including plush and firm options as well as down and down-alternative pillows from brands like Brooklinen.

Dog Insurance With Pre Existing Conditions

Fetch doesn't cover pre-existing conditions. Pet insurance covers unexpected injuries and illnesses — the things you can't see coming. Pre-existing conditions are not covered. Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. For all terms and. Embrace covers curable pre-existing conditions if your pet remains symptom-free and does not require treatments for one year from the date of the last. At Figo, we determine pre-existing conditions based on the last 12 months of your pet's medical history. We are unable to determine a specific condition's. Pet insurance doesn't usually cover pre-existing conditions. But a handful of insurers offer coverage. Here's how to find the best fit. Ask about pre-existing conditions and review the policy to see if they are covered. Look to see if the conditions are considered curable (stable or controlled. AKC Pet Insurance is the ONLY brand that offers coverage for curable and incurable pre-existing conditions after days of continuous coverage. Most pet insurance companies exclude pre-existing conditions and hereditary or congenital conditions from coverage. Even if your pet has a pre-existing condition, Pet Assure provides a practical way that you can still reduce the costs of any veterinary care that he may need. Fetch doesn't cover pre-existing conditions. Pet insurance covers unexpected injuries and illnesses — the things you can't see coming. Pre-existing conditions are not covered. Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. For all terms and. Embrace covers curable pre-existing conditions if your pet remains symptom-free and does not require treatments for one year from the date of the last. At Figo, we determine pre-existing conditions based on the last 12 months of your pet's medical history. We are unable to determine a specific condition's. Pet insurance doesn't usually cover pre-existing conditions. But a handful of insurers offer coverage. Here's how to find the best fit. Ask about pre-existing conditions and review the policy to see if they are covered. Look to see if the conditions are considered curable (stable or controlled. AKC Pet Insurance is the ONLY brand that offers coverage for curable and incurable pre-existing conditions after days of continuous coverage. Most pet insurance companies exclude pre-existing conditions and hereditary or congenital conditions from coverage. Even if your pet has a pre-existing condition, Pet Assure provides a practical way that you can still reduce the costs of any veterinary care that he may need.

We still accept dogs and cats with pre-existing conditions and can help keep unrelated veterinary expenses manageable for thousands of other covered conditions. Does Pet Insurance Cover Pre-existing Conditions? No pet insurance company covers pre-existing conditions. You can still obtain a policy at Embrace if. If your pet's treated for a covered condition during the policy term, some companies may consider it a pre-existing condition when the policy renews. As a. The best pet insurance should cover cured pre-existing conditions, and be affordable and extensive. Here's how the best pet insurance companies for. Yes, you can get pet insurance after a diagnosis; however, the diagnosed condition will be considered pre-existing and won't be covered. It refers to anything on-going, with symptoms or conditions pre-dating your policy. So, if your pet already has an injury or chronic disease, it probably won't. Listed below are typical exclusions from pet health insurance policies. This list is not comprehensive. Pre-existing conditions. Pre-existing conditions are. Spot has a day waiting period before coverage begins. What does Spot pet insurance not cover? Spot plans don't cover preexisting conditions. Other exclusions. No pet insurance will cover a pre-existing condition. No subscription-based community alternatives will cover them either. A pre-existing condition is any injury, illness, or irregularity noticed by you or your veterinarian before the end of your waiting period. Is my pet eligible. Buy Flexible Pet Insurance for Pre-Existing Conditions with up to £15k Vet Fee Cover. No upper age limit, no compulsory excess. What are things you should look for/ask the insurance company when looking at insurance for your pet? · Pre-existing conditions. · Breed-specific Certain breeds. A pre-existing condition is basically any illness or injury that your pet had before coverage started. The good news is, not all pre-existing conditions are. Even with an existing condition, there is still a good chance that you can receive cover for your pets with standard dog insurance, cat insurance, and most. No pet insurance will cover a pre-existing condition. No subscription-based community alternatives will cover them either. Pet health insurance does not cover pre-existing conditions. To know what to expect with coverage, it's worth knowing how these conditions are detected. No policy covers preexisting conditions, and some conditions that are covered may be considered preexisting if they develop up to a year after you enroll. If. Paw Protect distinguishes between curable and incurable pre-existing conditions, allowing for the greatest long-term coverage. You can, but most standard pet insurance policies will not offer this level of cover. Instead, you'll need to compare quotes from specialist providers. If a condition has been noted as pre-existing and excluded from coverage, the condition may be eligible for coverage once the condition has been deemed cured by.

500000 Life Insurance Cost

Wondering how much universal life insurance will cost you? The cost of universal life insurance for a $, policy can range widely from around $1, to. Find out how much life insurance costs. Learn more about what can influence a premium's cost and what to consider when buying life insurance. The average cost of a term life insurance premium is around $ a year. 1 The cost of term life insurance can be very affordable. Term life protection options · Coverage amount (i.e., death benefit): $,–$50,,* · Length of coverage: 10 to 40 years · Cost (premium): As low as $10/. Life insurance is a contract in which you pay premiums, and in return your beneficiary receives a lump-sum payout when you die. 15 Year Term $, - $1,, Sample Quotes ; Face Value, $,, $,, $,, $1,, ; Years-Old, $, $, $, $ ; Years-. Aflac offers whole and term life insurance policies that help pay cash benefits directly. Find out how much you really need to protect your loved ones! Discover how much does a $ life insurance policy cost. Buy a $ term life insurance policy in under 5 minutes for less than $30/month. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Wondering how much universal life insurance will cost you? The cost of universal life insurance for a $, policy can range widely from around $1, to. Find out how much life insurance costs. Learn more about what can influence a premium's cost and what to consider when buying life insurance. The average cost of a term life insurance premium is around $ a year. 1 The cost of term life insurance can be very affordable. Term life protection options · Coverage amount (i.e., death benefit): $,–$50,,* · Length of coverage: 10 to 40 years · Cost (premium): As low as $10/. Life insurance is a contract in which you pay premiums, and in return your beneficiary receives a lump-sum payout when you die. 15 Year Term $, - $1,, Sample Quotes ; Face Value, $,, $,, $,, $1,, ; Years-Old, $, $, $, $ ; Years-. Aflac offers whole and term life insurance policies that help pay cash benefits directly. Find out how much you really need to protect your loved ones! Discover how much does a $ life insurance policy cost. Buy a $ term life insurance policy in under 5 minutes for less than $30/month. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old.

$, Term Life Insurance Rates ; Age 65, $ ; Age 70, $ ; 20 Year, $, ; Age 45, $46 ; Age 50, $

Costs of a $ thousand dollar (half-million) life insurance policy can vary a lot - get your own rates today. Life insurance is a contract in which a policyholder pays premiums in exchange for a lump-sum death benefit that may be paid to the policyholder's. Guide to Life Insurance for Seniors Over 60 ; Average Annual Whole Life Insurance Rates for Men* · Average Rate · $,, $9, · $, ; Average Annual Term. A life insurance policy can help protect you and your family. Learn which type of life insurance is right for you. Get a free online quote. The average annual term life insurance premium for a year-old preferred applicant in good health is between $ and $ per year. Term life insurance coverage provides financial protection for your loved ones throughout your working years when your cost of insurance is typically less. Premiums for cash-value policies are much higher. For example, the healthy year-old man who pays $ a year for a $, term policy would pay about. For a year, $, term life insurance policy, a year-old non-smoking woman in excellent health can expect to pay an average of $ a year. A man of. Policy. VA» Veterans Benefits Administration» Life Insurance» SGLI Increase to $, FAQs insured for $10, of coverage at no cost to the member. If. To give you an example, take a year-old couple with a five-year-old child. They might consider purchasing term life insurance policies with $, in. How much does whole life insurance cost? A $, whole life insurance policy costs an average of $ per month for a year-old non-smoker in good health. A $, whole life insurance policy for that same woman would be about $ per month [Source: State Farm]. As you can see, the added financial protection. For a $, term life policy, the average annual life insurance premium for individuals between the age of 20 and 60 is $ That is less than $3 a. The SGLI premium rate is not changing. It remains at $ cents per thousand dollars of coverage. The premium for $, of coverage will be $30 monthly plus. Initially, less expensive form of life insurance. Level premiums. May be renewable or convertible. Some types of permanent insurance offer flexible premium. $, Coverage - Term Life Insurance Rates for a Female ; 45, $, $, $ ; 50, $, $, $ Average Cost for a $k Life Insurance Policy Based on Age, Gender, and Term Length ; Age/. Term. Male ; Age/. Term · year term, year term ; 30, $, $ Get Term Life Insurance with the coverage you need at a price you can afford $25,$, in coverage; 10, 15, 20, or 30 year terms; Apply. For a healthy year-old, a year term life policy with $, in coverage may cost between $15 and $25 per month. Whole life insurance premiums will be. Term life insurance premiums continue to increase as you age, and companies may not offer as many term options for older clients. For a year, $1 million term.

Cash Check At Atm Near Me

Use the CO-OP Network ATM Locator · Call SITECOOP () · Use your cell phone to text your location—address, intersection, zip code or city/state— to. check or cash. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. Please note that payments to business credit. Find Allpoint ATMs using our intuitive locator and mobile applications. Use the locator below to find a surcharge-free ATM near you. Find the Depositing a check? No problem! Save yourself some gas money and drive time. Customers of Fifth Third Bank can use their Fifth Third debit, ATM or prepaid card to conduct transactions fee-free from ATMs listed on our ATM locator. You can get cash, transfer funds, check your balance, make deposits and more at most Wells Fargo ATMs. While most Wells Fargo ATMs offer additional features and. Mastercard ATM Locator guides you to the nearest ATM location with just a click. Find ATMs from across the world quickly, easily & securely. Welcome to Bank of America's financial center location finder. Locate a financial center or ATM near you to open a CD, deposit funds and more. Regions DepositSmart ATMs are your convenient, quick solution for on-the-go banking. Get cash, transfer funds, check balances and get mini-statements. Use the CO-OP Network ATM Locator · Call SITECOOP () · Use your cell phone to text your location—address, intersection, zip code or city/state— to. check or cash. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. Please note that payments to business credit. Find Allpoint ATMs using our intuitive locator and mobile applications. Use the locator below to find a surcharge-free ATM near you. Find the Depositing a check? No problem! Save yourself some gas money and drive time. Customers of Fifth Third Bank can use their Fifth Third debit, ATM or prepaid card to conduct transactions fee-free from ATMs listed on our ATM locator. You can get cash, transfer funds, check your balance, make deposits and more at most Wells Fargo ATMs. While most Wells Fargo ATMs offer additional features and. Mastercard ATM Locator guides you to the nearest ATM location with just a click. Find ATMs from across the world quickly, easily & securely. Welcome to Bank of America's financial center location finder. Locate a financial center or ATM near you to open a CD, deposit funds and more. Regions DepositSmart ATMs are your convenient, quick solution for on-the-go banking. Get cash, transfer funds, check balances and get mini-statements.

Deposit Cash or Checks with Your Debit Card · Transfer Money Between Accounts ATM Locator. Home · Consumers; ATM Locator. You need to enable JavaScript to. When making a deposit, simply insert cash or checks and the ATM does the rest. Find an ATM near you. It's easy with our ATM Locator. Give Us Feedback. ATM locator. Access ATMs on the go. Find nearby U.S. Bank ATMs in seconds with our ATM locator. Look for it in the U.S. Bank Mobile App or at. Use our ATM Locator to That's more than Chase & Bank of America combined! Near Me. or. City, State, or Zip Search. Search For. Only Deposit Taking ATMs. Cash deposits made at a U.S. Bank ATM are credited to your account the same business day. Checks deposited before 8 p.m. local time are posted the same day. ATM near you. ATM deposits are easier than ever. STEP. 1. Insert your cash and checks² right into the ATM. No deposit slips or envelopes needed! STEP. 2. Review. Here are some things to consider the next time you need to deposit money during non-banking hours: Locate an ATM: If your bank has an ATM nearby, and it. Bank online through Chime for cash withdrawals at fee-free ATMs1 using your debit card. Just launch the ATM Finder in your Chime app to find ATMs near you. You. ATM or cash deposit accepting Allpoint+® ATM near you. Please be advised Cash withdrawals, cash deposits and check deposits can be made at the ATM on site. Use our ATM Locator to That's more than Chase & Bank of America combined! Near Me. or. City, State, or Zip Search. Search For. Only Deposit Taking ATMs. Simply insert cash or checks and the ATM does the rest. The ATM scans your checks, counts your bills, and totals them on screen. Find the nearest PNC Bank branch location, solution center, ATM or partner ATM to you. Check lobby and drive-thru hours and get contact information. Deposit cash and checks in a flash. Insert your checks and bills without an envelope. Cash deposits are credited to your account instantly. Simply put your. At ATMs labeled as Cash & Check Deposit or Check Deposit on our locator, you can securely make a deposit. ATMs that are Cash & Check Deposit do not require an. The MoneyPass ATM Locator can help you find the closest ATMs that can provide surcharge-free cash withdrawals for your MoneyPass card. Finding an Allpoint ATM is easy! Just look for the Allpoint logo or, better yet, use our locator. Contact your financial institution to see if your account. Please check your device SETTINGS and ensure that your GEOLOCATION is set to ON. Search ATMs by address, airport code, or landmark. Get Cash Access - enrol now. Use our locator to find a Navy Federal Credit Union branch or ATM near you Cash deposits at a Navy Federal ATM will be available immediately for cash. Use Ally Bank's ATM locator to find ATM and cash locations near you. Use any of the + Allpoint® ATMs in the U.S. for free. Ally Bank, Member FDIC. Find an ATM near you using the convenient Axos Bank ATM locator. You can Deposit-taking ATMs shown may not accept both cash and check. Some may.

Casinos That Play For Real Money

FanDuel Casino is the #1 Rated Online Casino app, where you can play fully regulated online casino games for real money in Michigan, Pennsylvania, New Jersey. Explore the online casino options offered by the Hard Rock Hotel & Casino in Atlantic City for when you can't make it down to the Boardwalk. Play video slots and real Las Vegas casino slots on Cash Storm. Win coins and play huge jackpots on all the best slots! Get coin and bonus increases on. ESPN BET featuring Hollywood Casino includes all your favorite casino games, plus unique offers, promotions, and exclusive content. Lucky Creek is the top online casino in Texas for high-RTP online slots. Not only will you find an amazing selection of slot games to play – but you can also. FanDuel is one of our top picks among the best online casino real money sites, and it's easy to see why. Between its wide selection of slots, a top-notch user. Discover the best US real money online casinos including BetMGM and DraftKings. Play real cash slots and games + claim bonuses worth up to $! The best win real money online casinos will be listed here according to player reviews, payout speed, game selection, and variety. BetMGM is the best real money online casino in the United States. It offers a peerless range of games, including more than 1, high-quality slots and dozens. FanDuel Casino is the #1 Rated Online Casino app, where you can play fully regulated online casino games for real money in Michigan, Pennsylvania, New Jersey. Explore the online casino options offered by the Hard Rock Hotel & Casino in Atlantic City for when you can't make it down to the Boardwalk. Play video slots and real Las Vegas casino slots on Cash Storm. Win coins and play huge jackpots on all the best slots! Get coin and bonus increases on. ESPN BET featuring Hollywood Casino includes all your favorite casino games, plus unique offers, promotions, and exclusive content. Lucky Creek is the top online casino in Texas for high-RTP online slots. Not only will you find an amazing selection of slot games to play – but you can also. FanDuel is one of our top picks among the best online casino real money sites, and it's easy to see why. Between its wide selection of slots, a top-notch user. Discover the best US real money online casinos including BetMGM and DraftKings. Play real cash slots and games + claim bonuses worth up to $! The best win real money online casinos will be listed here according to player reviews, payout speed, game selection, and variety. BetMGM is the best real money online casino in the United States. It offers a peerless range of games, including more than 1, high-quality slots and dozens.

Make BetMGM your one-stop online casino. % Deposit Match Welcome Offer. Slots, Blackjack, Roulette, Craps & Live Dealer Experience. Gambling for real money online in the United States isn't so different from playing in a Vegas casino. Once you've decided on the best online casino for you. The Best Casino Apps that pay real money in · DraftKings Casino App · FanDuel Casino App · Caesars Palace Online Casino App · BetMGM Casino App · Borgata Casino. Real Cash Prizes: Play games with Gems to win cash. $Vega$, 1 star, April “Take your money to the actual casino if you want to gamble. Real money online gambling with BetMGM Casino allows you to gamble online in NJ, PA, MI, and WV for a chance to win real money. Why DraftKings Casino? ; Easy To Play. As easy as opening your phone, hitting the app, and playing all your favorite games. ; One Login. One password to remember. Most popular. Online gambling ; Real money guides. Casino bonuses · Online gambling ; Casino reviews · Ruby Fortune Casino · Jackpot City Casino ; Casino games. Classic casino table games like roulette,blackjack, craps, baccarat, and poker are also incredibly common at the best real-money online casinos. With plenty of. Enjoy the best online casino games in the business, from the comfort of your home or on the go using your mobile device. You can enjoy our real money slots and other casino games from your home PC, directly in your browser via our Instant Play platform, or on your mobile device. BetMGM is the market leading real money online casino in the United States. It offers a huge variety of games, including more than 1, high-quality slots and. The home of online casino games, including Slots, Blackjack, the #1 Live Casino in the US, Roulette & more at FanDuel Casino. Zula casino, Pulsz, Modo, Hello millions, Mcluck, Luckyland, Chumba, High5casino, FortuneCoins, Most take under a week to cash out once verified. Baccarat · Poker · Blackjack · Roulette · Craps; Sic Bo; Keno · Slots · Pai Gow · Texas Hold'em. Sites that offer players real. A real money online casino is a type of online casino that lets you bet real, hard cash on casino games. In contrast to social casinos, where you cannot leave. Play genuine Vegas casino slots for free or real money. % safe, with no pop-up ads, and no sign-up requests - trusted by millions, since real casino games that pay out in real money. From slots and roulette, to blackjack and video poker. Get $10 free to Play. Top Casino Sites · BetMGM Casino - Top choice for online poker and card games · Caesars Palace Online Casino - Best online casino bonuses and promos · FanDuel. Baccarat; Blackjack; Craps; Slots (More than 1,+ to choose from!) Jackpot Slots; Roulette; Video Poker; Live Dealer casino games . Play Casino Games Online and Earn Valuable Caesars Rewards® Credits When you play real money games at Tropicana Casino Online, you can also become a member of.

Can I Consolidate My Student Loans Twice

A Direct Consolidation Loan allows you to combine multiple federal student loans into one loan, one payment and one fixed interest rate. You can consolidate a consolidation loan only once. In order to reconsolidate an existing consolidation loan, you must add loans that were not previously. Consolidation can put all of your federal student loans in one place. · There are some situations however, where consolidation is a very good idea. Consolidating federal student loans can lower the payment and usually does, but not always. What you have to be careful about when consolidating. You should only consolidate your federal loans into a private loan consolidation if you have an extremely robust emergency fund, steady employment, and a very. Borrowers with multiple federal student loans can consolidate loans and make payments over years. In addition, the government offers income-driven. A: In most situations the answer is “no”. Once you have consolidated your federal student loans, there are very few exceptions in which you would be eligible to. Under normal PSLF Program rules, if you consolidate your loans, only qualifying payments that you make on the new Direct Consolidation Loan can be counted. If you want to refinance twice or even more, you have the ability to do so. And in some cases, refinancing again can help you save even more money than you did. A Direct Consolidation Loan allows you to combine multiple federal student loans into one loan, one payment and one fixed interest rate. You can consolidate a consolidation loan only once. In order to reconsolidate an existing consolidation loan, you must add loans that were not previously. Consolidation can put all of your federal student loans in one place. · There are some situations however, where consolidation is a very good idea. Consolidating federal student loans can lower the payment and usually does, but not always. What you have to be careful about when consolidating. You should only consolidate your federal loans into a private loan consolidation if you have an extremely robust emergency fund, steady employment, and a very. Borrowers with multiple federal student loans can consolidate loans and make payments over years. In addition, the government offers income-driven. A: In most situations the answer is “no”. Once you have consolidated your federal student loans, there are very few exceptions in which you would be eligible to. Under normal PSLF Program rules, if you consolidate your loans, only qualifying payments that you make on the new Direct Consolidation Loan can be counted. If you want to refinance twice or even more, you have the ability to do so. And in some cases, refinancing again can help you save even more money than you did.

Debt consolidation means taking out a single loan that can be used to pay off your other debts, such as credit cards, lines of credit, student loans and car. on average, twice the amount of the annual If you have both federal student loans and private student loans, you should consolidate them separately. Consolidation could lower your monthly payments when payments begin again. However, consolidation could also extend your repayment period (how long it takes you. You have to combine at least two loans. So just submit a paper application consolidating one of the consolidation loans and the PP loan. Then. The key to using the double consolidation loophole is to consolidate each of your Parent PLUS Loans twice. In this scenario, a borrower can have as few as two. The key to using the double consolidation loophole is to consolidate each of your Parent PLUS Loans twice. In this scenario, a borrower can have as few as two. Refinancing student loan debt may not be the answer for everyone. You should refinance your student loans if you are looking to make one payment to one lender. Refinancing student loan debt may not be the answer for everyone. You should refinance your student loans if you are looking to make one payment to one lender. The Savi tool will alert you if you need to consolidate loans to qualify for PSLF. Any type of Direct Loan, a low-interest federal loan issued through the U.S. Student loan refinancing happens when you apply for a new loan to pay off your existing student loans. Borrowers tend to do this to lower their borrowing costs. Both rehabilitation and consolidation are available only once for each federal student loan. But it's possible to consolidate just one loan. So, you could get. There is no limit to how much can be forgiven by PSLF. The program forgives the remaining balance of your federal student debt after 10 years of service and All federal direct loans and many private lenders offer this discount. Extra payments can get you out of debt faster and save you money on interest—if you can. If you have a Direct Consolidation Loan or a Federal Consolidation Loan, you may be eligible for forgiveness of the outstanding portion of the consolidation. You are then responsible for paying off the new loan using one monthly payment. The benefit of refinancing is that it can combine multiple loans into one simple. Borrowers with the former Federal Family Education Loan (FFEL) program can consolidate loans into a new Direct Consolidation Loan, which means they can be used. program or consolidate your defaulted loan(s). In all instances, contact How do I remove a defaulted student loan from my credit report? A. Student. You are then responsible for paying off the new loan using one monthly payment. The benefit of refinancing is that it can combine multiple loans into one simple. Borrowers with two PLUS Loans should consolidate each one separately with a different loan servicer into its own Direct Consolidation Loan. Then, they need to. A common misconception about refinancing student loans is that borrowers can't refinance federal loans – a myth While the bill was blocked (twice) by Senate.

Black Litterman Asset Allocation

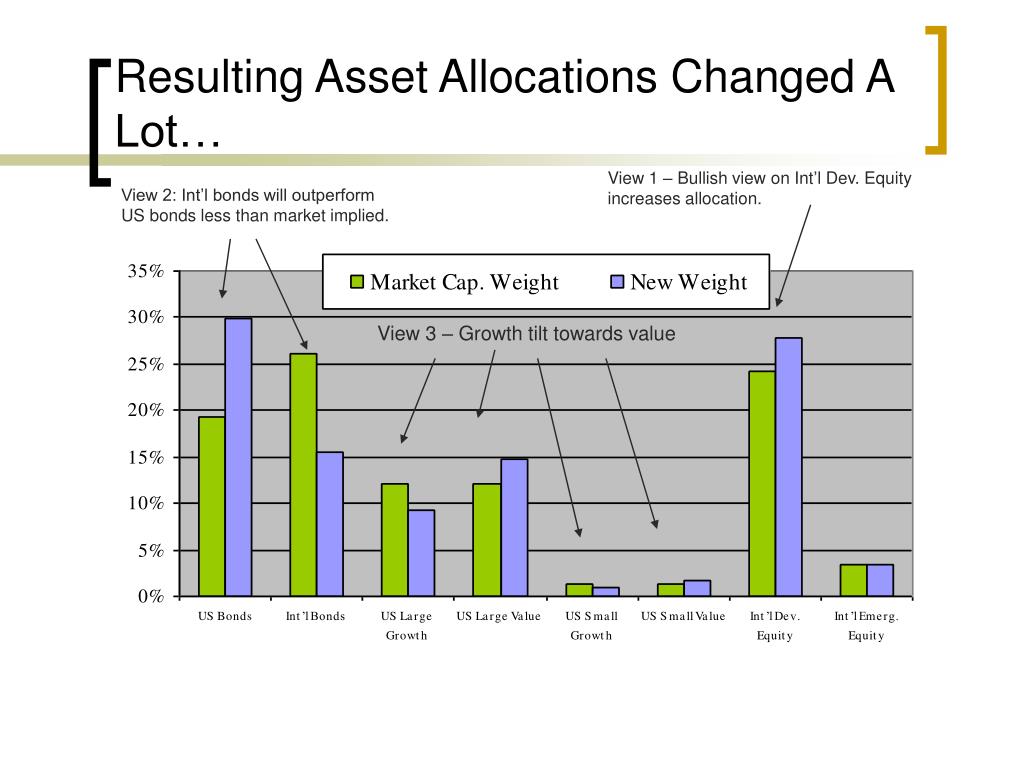

The Black-Litterman asset allocation model addresses those practical issues in using the Markowitz framework by allowing the portfolio manager to express views. Abstract: The Black-Litterman model is inadequate in measuring risks of investment products. The author makes changes for the original model based on. A Black-Litterman model calculates stable expected returns which are fed into a Mean-Variance Optimizer, which uses the returns in conjunction. Within the scope of this thesis, the Black-Litterman Asset Allocation Model (as presented in He & Litterman, ) is compared to the classical. The Black-Litterman (BL) model [1] takes a Bayesian approach to asset allocation. Specifically, it combines a prior estimate of returns (for example, the market. The Black-Litterman model represents a sophisticated and structured approach. This model, developed by Fischer Black and Robert Litterman at Goldman Sachs. The Black-Litterman Model is used to determine optimal asset allocation in a portfolio Using Black-Litterman model to determine asset allocation of 12 sectors. The Black-Litterman model can be used for asset allocation, where "assets" are defined in terms of asset classes/sectors/countries etc. or for individual. The Black–Litterman model is a mathematical model for portfolio allocation developed in at Goldman Sachs by Fischer Black and Robert Litterman. The Black-Litterman asset allocation model addresses those practical issues in using the Markowitz framework by allowing the portfolio manager to express views. Abstract: The Black-Litterman model is inadequate in measuring risks of investment products. The author makes changes for the original model based on. A Black-Litterman model calculates stable expected returns which are fed into a Mean-Variance Optimizer, which uses the returns in conjunction. Within the scope of this thesis, the Black-Litterman Asset Allocation Model (as presented in He & Litterman, ) is compared to the classical. The Black-Litterman (BL) model [1] takes a Bayesian approach to asset allocation. Specifically, it combines a prior estimate of returns (for example, the market. The Black-Litterman model represents a sophisticated and structured approach. This model, developed by Fischer Black and Robert Litterman at Goldman Sachs. The Black-Litterman Model is used to determine optimal asset allocation in a portfolio Using Black-Litterman model to determine asset allocation of 12 sectors. The Black-Litterman model can be used for asset allocation, where "assets" are defined in terms of asset classes/sectors/countries etc. or for individual. The Black–Litterman model is a mathematical model for portfolio allocation developed in at Goldman Sachs by Fischer Black and Robert Litterman.

The Black Litterman model is a mathematical financial model developed for portfolio allocation incorporating views of investors and market equilibrium. The Black-Litterman (BL) model is one of the many successfully used portfolio allocation models out there. Developed by Fischer Black and Robert Litterman at. The Black-Litterman asset allocation model allows an investor to construct a portfolio based around the "market portfolio", but accounting for their own views. The Black–Litterman model is a mathematical model for portfolio allocation developed in at Goldman Sachs by Fischer Black and Robert Litterman. The Black-Litterman (BL) model [1] takes a Bayesian approach to asset allocation. Specifically, it combines a prior estimate of returns (for example, the market. The Black-Litterman asset allocation model combines ideas from the Capital Asset Pricing Model (CAPM) and the Markowitz's mean-variance optimization model to. The Black-Litterman model is a mathematical approach used to optimize asset allocation by combining market equilibrium returns with an investor's views on. The Black-Litterman method is a very powerful way of converting your views on asset returns, along with your uncertainty in these views, into a portfolio. Portfolio Theory in a Mean-Variance world. 2. Capital Asset Pricing Model (CAPM). 3. Estimating Mean and CoVariance matrix. 4. Black-Litterman Model. allocate more assets to them. How do you think the Black–Litterman model impacts your asset allocation's risk? That's not it. You'd be improving returns. Black-Litterman is an asset allocation model that allows portfolio managers to incorporate views into CAPM equilibrium returns and to create more diversified. In contrast to the Markowitz model, Black and Litterman use the equilibrium portfolio as the reference point. The equilibrium portfolio can be constructed in. Hi everyone, I'm currently exploring the Black-Litterman model for portfolio optimization and asset allocation as a part of my thesis. This paper provides a richer formulation of the Black-Litterman model that is flexible enough to incorporate investor information on volatility and market. The BLM applies both absolute and relative views about the asset returns. The paper proves that the currently applied relative views with equal weights are. Our job is to understand that Black-Litterman formula. It supposedly gives the expected returns of the various portfolio assets in terms of their "implied". This paper consolidates and compares the applicability and practicality of Black-Litterman model versus traditional Markowitz Mean-Variance model. Posterior estimates of expected returns & covariance using the Black-Litterman Portfolio Optimization Method: 10 Best Diversified Stocks. The analysis applies a simple multi-asset portfolio consisting of equities (SPX Index) and bonds (LUATTRUU Index). Generating portfolio allocations using. This paper introduces a suitable extension of the Black-Litterman Bayesian approach to portfolio construction in the presence of non-trivial preferences.

Poor Credit Auto Loan Rates

Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus. They have no minimum credit score, offer thousands of used cars to choose from, and have fair starting loan rates. Ally – Best Bad Credit Auto Loans From a Bank. Average Interest Rates for Car Loans with Bad Credit ; Prime (), %, % ; Nonprime (), %, % ; Subprime (), %, % ; Deep. How to Get an Auto Loan if You Have Bad Credit This would give them a better chance of getting their auto loans approved, helping them get better loan rates. Average Auto Loan Rates for Bad Credit ; Credit Score, New Car Loan, Used Car Loan ; , %, %. Where someone with good credit might pay 4%-8% interest (it's generally % over the prime rate), someone with poor credit might pay 12%% (or more). The. Like with a bad credit loan, a bankruptcy auto loan may subject you to paying higher interest rates, require a co-signer or make it necessary for you to put. Car loan interest rates for borrowers with bad credit typically range between %, with most averaging around 20%. The exact rate offered will depend on. Best Providers for Low-Interest Auto Loans · 1. Auto Credit Express · 2. LendingTree · 3. daisy.net.ru · myAutoloan. Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus. They have no minimum credit score, offer thousands of used cars to choose from, and have fair starting loan rates. Ally – Best Bad Credit Auto Loans From a Bank. Average Interest Rates for Car Loans with Bad Credit ; Prime (), %, % ; Nonprime (), %, % ; Subprime (), %, % ; Deep. How to Get an Auto Loan if You Have Bad Credit This would give them a better chance of getting their auto loans approved, helping them get better loan rates. Average Auto Loan Rates for Bad Credit ; Credit Score, New Car Loan, Used Car Loan ; , %, %. Where someone with good credit might pay 4%-8% interest (it's generally % over the prime rate), someone with poor credit might pay 12%% (or more). The. Like with a bad credit loan, a bankruptcy auto loan may subject you to paying higher interest rates, require a co-signer or make it necessary for you to put. Car loan interest rates for borrowers with bad credit typically range between %, with most averaging around 20%. The exact rate offered will depend on. Best Providers for Low-Interest Auto Loans · 1. Auto Credit Express · 2. LendingTree · 3. daisy.net.ru · myAutoloan.

Individuals with good credit scores will likely pay interest rates as low as 4%, but those with poor credit scores can pay up to 29%. The question is, How do. Why choose Legacy Auto Credit? · Low-kilometre vehicles, so you can drive a reliable vehicle · Industry-leading auto loan rates — we'll never charge you 30% rates. Our new and used Toyota dealership works with many lenders and we enjoy a high rate of bad credit car loan approval so don't let past repossessions. Our new and used Toyota dealership works with many lenders and we enjoy a high rate of bad credit car loan approval so don't let past repossessions. Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus. Your local credit union may provide extra vehicle protection features to members at significantly lower rates than banks, such as multi-shield coverage. Why Are Poor Credit Car Loans Usually Shorter? For lenders, short loan terms on bad credit auto loans help cut down on risk and can benefit you, the borrower. You may even be denied for a loan, depending on how bad it is. And your interest rate will significantly impact your monthly payment. It's best, if you have the. auto financing incentives to help you get the most out of your driving experience. Low auto loan rates are just around the corner: visit the finance center. One difference to expect is a higher interest rate. The average interest for an auto loan for a driver with good credit is around 5 percent. A comparable plan. Fresh Auto Loan Rate As Low As % APR. Apply Today! Menu Typically, people with low credit scores will receive loans with higher interest rates. APR includes the interest rate to be charged on the principal loan amount (the sum borrowed to buy a vehicle) and any transaction fees that are rolled into the. Higher interest rates for bad credit car loans can be as low as 11% or close to 50%. Should I Make a Downpayment? While you can get a car loan without a. What Are Subprime Lending Rates? Usually, if you receive a credit score lower than , you are looking into subprime car loans. If you are getting approved. Other than the necessary qualifications and the interest rates, bad credit car loans are exactly the same as typical auto loans. What Got You Here: Credit Score. Because bad credit financing by definition involves a higher degree of risk, lenders often can charge anywhere from 8% to 18% for such auto loans depending on. One of the best ways to restore your credit is an auto loan. Our prices are very low and the Parkway Chevrolet Finance Department offers competitive rates and. Best Car Loans for Bad Credit of · Best for Most Borrowers: AUTOPAY · Best for Only Used Car Loans: CarMax · Best for Full Car Buying Experience: Carvana. What are the average interest rates for bad credit car loans? Consumers with good credit should pay an average of % on loans for automobiles. Subprime auto. The interest rate for someone with bad credit varies from % all the way up to % for a new car, and % to % or more on average for a used car.

Webull Account Fees

Webull offers all the investing products you need - stocks, ETFs, options, futures, and more—no matter your experience level. Earn % on your uninvested. Fintech firms like WeBull make their money by offering paid subscriptions to market quotations and making around $ monthly or $ a year. WeBull is also. A $ per contract fee applies for certain index options and a $ per contract fee applies for oversized option orders. Relevant regulatory and exchange. Margin fees: Margin traders pay fees to Webull to use leverage. This is common among brokers who offer margin accounts. Order flow management: This part is a. A $ per contract fee applies for certain index options and a $ per contract fee applies for oversized option orders. Relevant regulatory and exchange. Non-Gold margin rate is 12%. 1.$0 commission trading is available only to U.S. residents trading in the U.S. markets through Moomoo Financial Inc. Other fees. Platform Fee, 0, Webull ; Regulatory Transaction Fee (Sell Trades Only), USD * Total Trade Amount (Min. USD ), US Securities and Exchange. TRADE WITH $0 COMMISSION FEES - Transfer your investments to Webull and claim a % cash bonus for a limited time. - Trade stocks, ETFs, and options. Trade stocks on Webull with no commission fees. Access powerful trading tools and insights to support your strategy. Webull offers all the investing products you need - stocks, ETFs, options, futures, and more—no matter your experience level. Earn % on your uninvested. Fintech firms like WeBull make their money by offering paid subscriptions to market quotations and making around $ monthly or $ a year. WeBull is also. A $ per contract fee applies for certain index options and a $ per contract fee applies for oversized option orders. Relevant regulatory and exchange. Margin fees: Margin traders pay fees to Webull to use leverage. This is common among brokers who offer margin accounts. Order flow management: This part is a. A $ per contract fee applies for certain index options and a $ per contract fee applies for oversized option orders. Relevant regulatory and exchange. Non-Gold margin rate is 12%. 1.$0 commission trading is available only to U.S. residents trading in the U.S. markets through Moomoo Financial Inc. Other fees. Platform Fee, 0, Webull ; Regulatory Transaction Fee (Sell Trades Only), USD * Total Trade Amount (Min. USD ), US Securities and Exchange. TRADE WITH $0 COMMISSION FEES - Transfer your investments to Webull and claim a % cash bonus for a limited time. - Trade stocks, ETFs, and options. Trade stocks on Webull with no commission fees. Access powerful trading tools and insights to support your strategy.

WeBull Fees List ; HK$0 · HK$0 (via electronic channels) & %(Min HK$)(via telephone) · HK$10/transaction · Through Cash:HK$50/per application & Through. *Introductory zero commission promotion for 90 days from date of successful account opening. Offered at Webull's discretion – refer to Pricing page for fees. Webull does not charge commissions for trading stocks, ETFs and options listed on US exchanges. Webull does charge a $ per contract fee for certain index. Yes, Webull charges no fees but the SEC and FINRA charge fees for any trade, including options. For stocks, it's super negligible. No Commission & Low Contract Fees. Trade Options with Webull without contract fees or commissions for stock & ETF options. Only $ per contract on index. No Commission & Low Contract Fees. Trade Options with Webull without contract fees or commissions for stock & ETF options. Only $ per contract on index. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC individual cash or margin accounts. Index Option Contract Fees. Webull offers a modern trading and investing platform with low costs, advanced trading tools and a robo-advisor. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. A $ per contract fee applies for certain index options and a $ per contract fee applies for oversized option orders. Relevant regulatory and exchange. Invest in stocks, ETFs, and options, all commission-free. No margin interest or short selling fees for intra-day trading. Webull is an online trading platform that offers zero-commissions trading. That means they do not impose any fees for buying or selling stocks, options, or. No Direct Fees: Webull Pay does not charge separate fees for trading cryptocurrencies. Instead, a 1% markup ( basis points) is included in the buying and. Best Overall: Interactive Brokers · Account Minimum: $ · Fees: $ commissions for equities/ETFs available on IBKR's TWS Lite, or low costs scaled by volume. Webull Stock Trading / $0 Commission and No Minimum · Commission-free trading on stocks, ETFs, options, and cryptocurrencies · No minimum deposit is required. Secure. Your Webull Cash Management is insured up to $ million. ; Exceptional rates. Earn % APY on your idle cash. ; No fees attached. No account opening. Start your option trading journey in 3 easy steps. Open an account, fill out our simple application form, fund your account, deposit funds securely with any. Webull offers lows fees with $0 commission on U.S. stock and ETFs, and no inactivity fees, certain activities fees do apply. Webull's trading platforms are. Webull has no minimums to open an account and users don't need to reach a minimum to start investing, either. Webull doesn't charge commission fees to trade. Webull offers commission-free trading for stocks, ETFs, options, and cryptocurrencies, appealing to beginners and seasoned investors. With a user-friendly.